Meet with a liaison officer who will answer tax-related questions, discuss common errors, and bookkeeping best practices. Excise taxes, duties, and levies. Customs, excise taxes and duties, fuel charge, air travellers' security charge, and cannabis duty. Charities and giving.. For example, a Canadian corporation that carries on business in the province of Ontario through a permanent establishment is generally liable for income tax at a combined rate of 26.5%, consisting of federal tax levied at a rate of 15% and Ontario tax levied at a rate of 11.5%. A lower rate applies in respect of certain manufacturing and.

BPSC Topper Aniket Amar, Commercial Tax Officer. (Rank 46) Mock Interview YouTube

Tax Officer Exam 2023 2024 EduVark

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

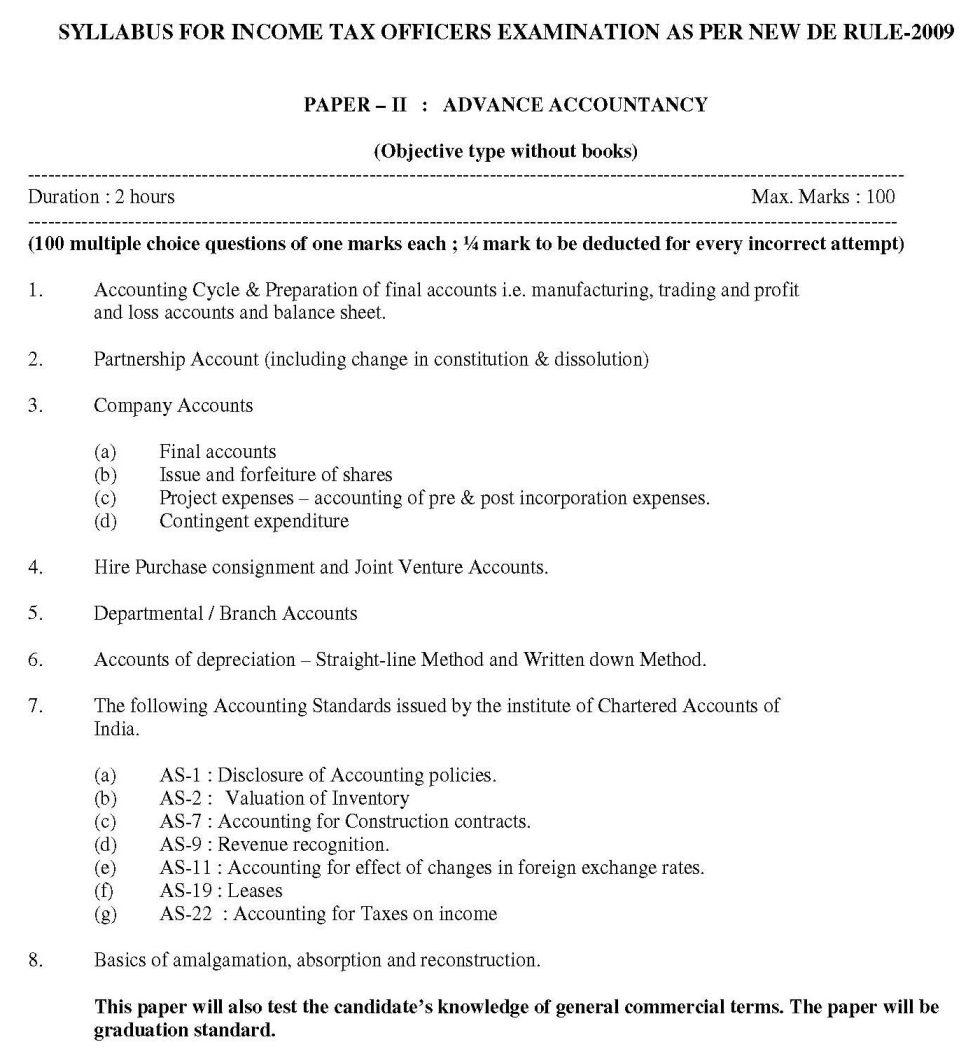

Syllabus of Tax Officer for Preparation 2023 2024 EduVark

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

Commercial tax inspector recruitment 2022/23 KPSC RECRUITMENT IN KANNADA syllabus kpsc

Part III OSSC ASSISTANT COMMERCIAL TAX OFFICER PREVIOUS YEAR QUESTION PAPER

Wastage of oil Taxscan Simplifying Tax Laws

UPPSC Topper Ashish Mathur, Commercial Tax Officer Mock Interview YouTube

HemalathaBC , COMMERCIAL TAX OFFICER (Rank 29, KAS 2017) mock interview at INSPIRO IAS KAS YouTube

KPSC Commercial Tax Officer Syllabus & Exam Pattern 2020 Download

COMMERCIAL TAX OFFICER FEBRUARY 2,2015 FULL SOLVED PAPER EXAMCHOICES.IN

COMMERCIAL TAX TAXES SYLLABUS EXAMCHOICES.IN

CTO COMMERCIAL TAX OFFICER APPSC/TSPSC GROUP 1 JOB PROFILE BY V GLORY YouTube

Akshar Shah tax Officer) LAKSH Career Academy

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

State Tax Tax OfficerCTOPrevious year questions and answersKerala PSCPart

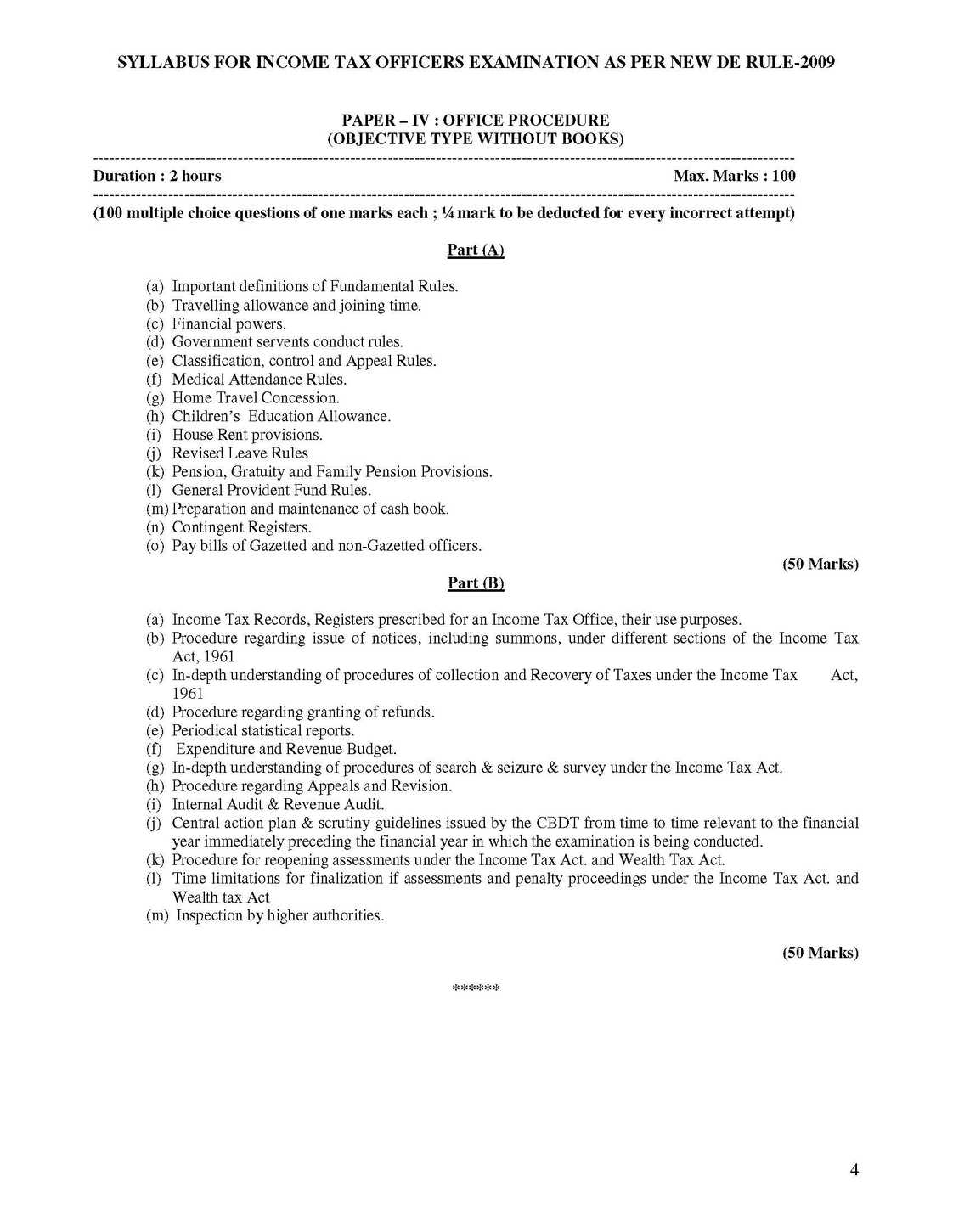

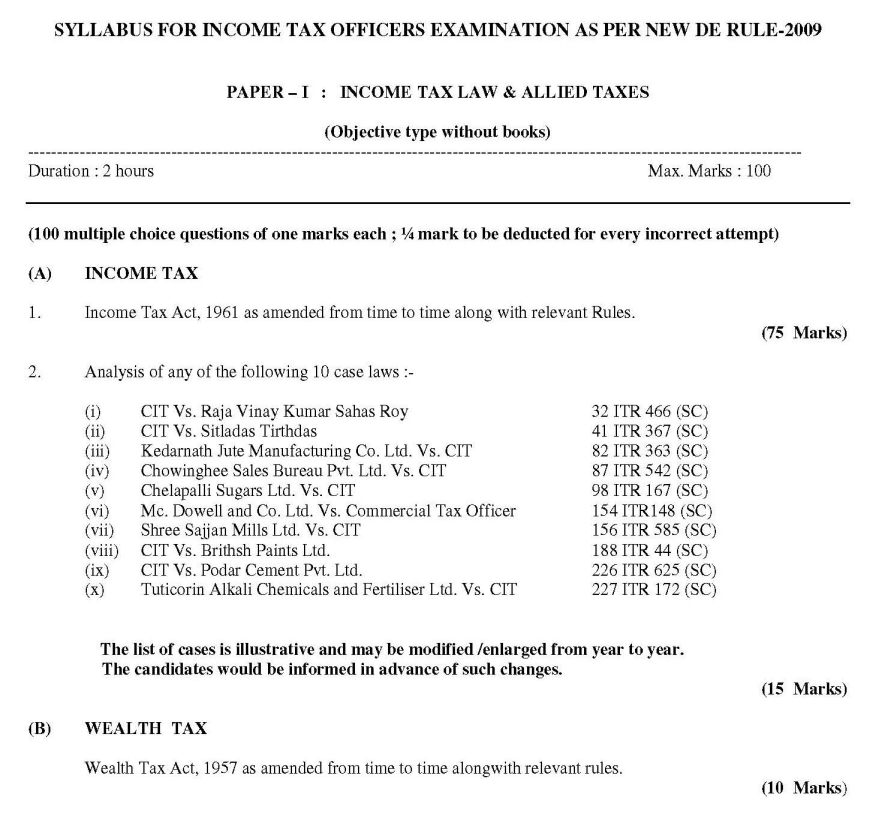

Syllabus of Tax Officer for Preparation 2023 2024 EduVark

KPSC Commercial Tax officer Exam 2015 Code Tax officer Kerala PSC Exams

You can become an income tax inspector by clearing the staff selection commission-combined graduate level (SSC CGL) exam. See below the steps to become an income tax officer through the SSC CGL exam: 1. Get a bachelor's degree. The minimum educational qualification for CGL is a bachelor's degree.. The State Trading Corporation has been assessed to sale tax by the Commercial Tax Officer, Vishakhapatnam and a demand has been made upon it. By this petition under Article 32 of the Constitution it challenges the demand on the ground inter alia that the impugned order and the demand for the tax infringe its fundamental rights which are guaranteed to citizens by Article 19 sub-clauses (f) and (g).