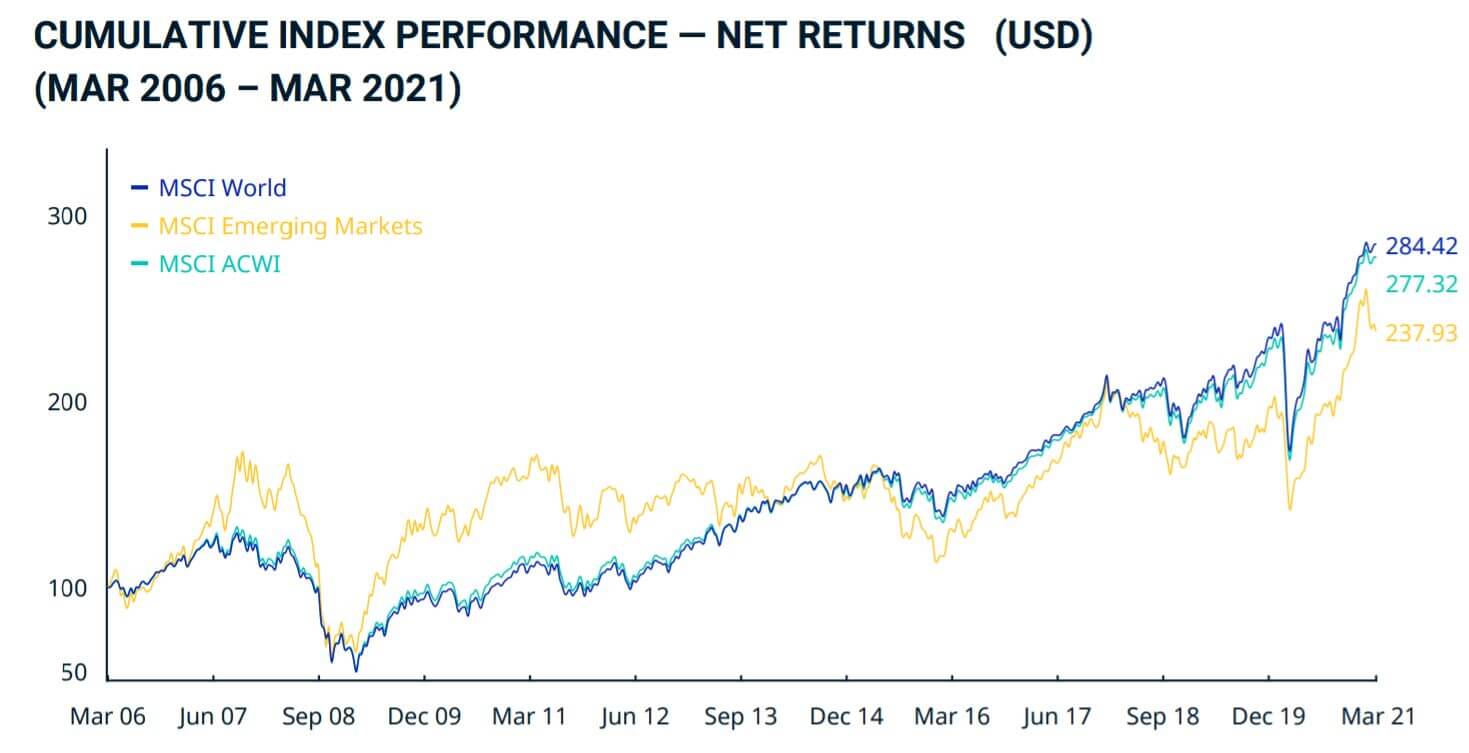

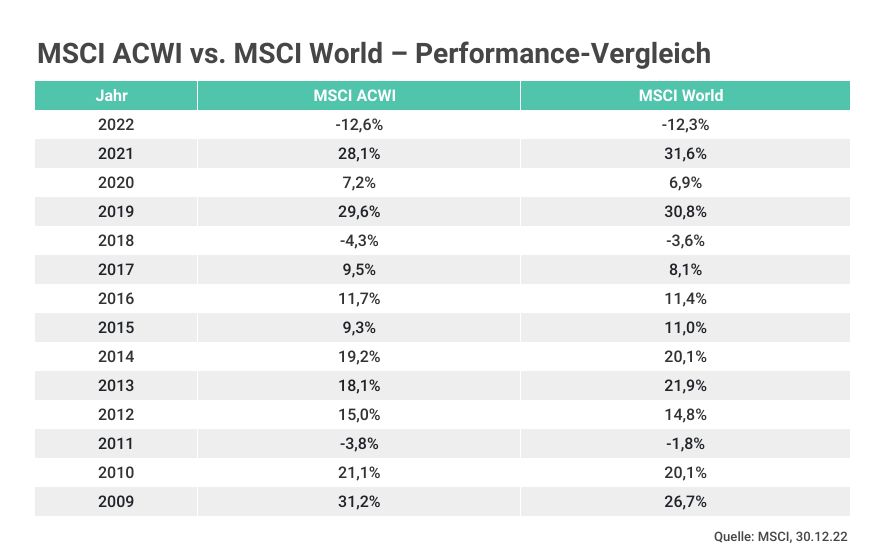

MSCI World was launched in 1986, while MSCI ACWI was launched in 2001. However, MSCI has back-tested performance data going back to (at least) 1987. Since then, the two indices have performed nearly identically. MSCI World has an annualized performance of 7.79%, while MSCI ACWI was an annualized performance of 7.63%.. Morgan Stanley Capital International All Country World Index Ex-U.S. - MSCI ACWI Ex-U.S.: A market-capitalization-weighted index maintained by Morgan Stanley Capital International (MSCI) and.

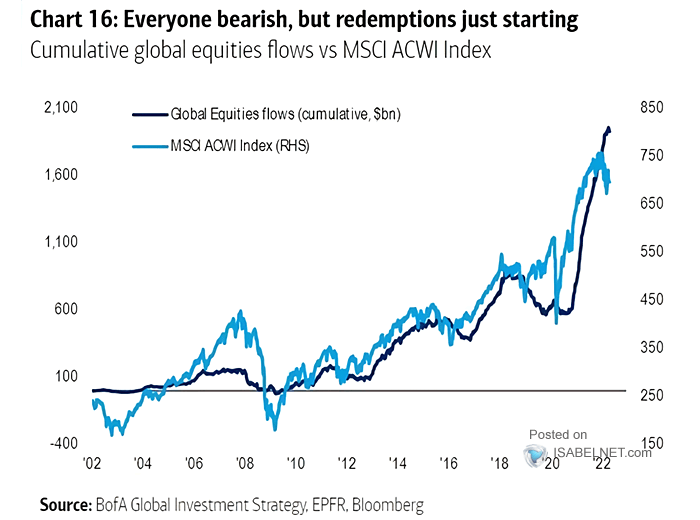

Cumulative Global Equities Flows vs. MSCI ACWI Index

MSCI ACWI vs MSCI World im großen Vergleich 2024

MSCI ACWI vs. MSCI World Han Yan

Globale Aktien seit 1971 Das Renditedreieck für den MSCI World Index

MSCI All Countries World ETF Vergleich Die besten ETFs auf den ACWI 2022 Die besten ETFs

MSCI ACWI vs. MSCI World Vergleich Welcher ETF ist besser?

MSCI ACWI vs MSCI World welches Investment passt zu dir?… Flickr

MSCI ACWI IMI vs. MSCI World CAPinside

MSCI ACWI vs MSCI World Key Differences (2023)

S&P 500 versus the MSCI All Country World Index and the Dimensional All Country World Research

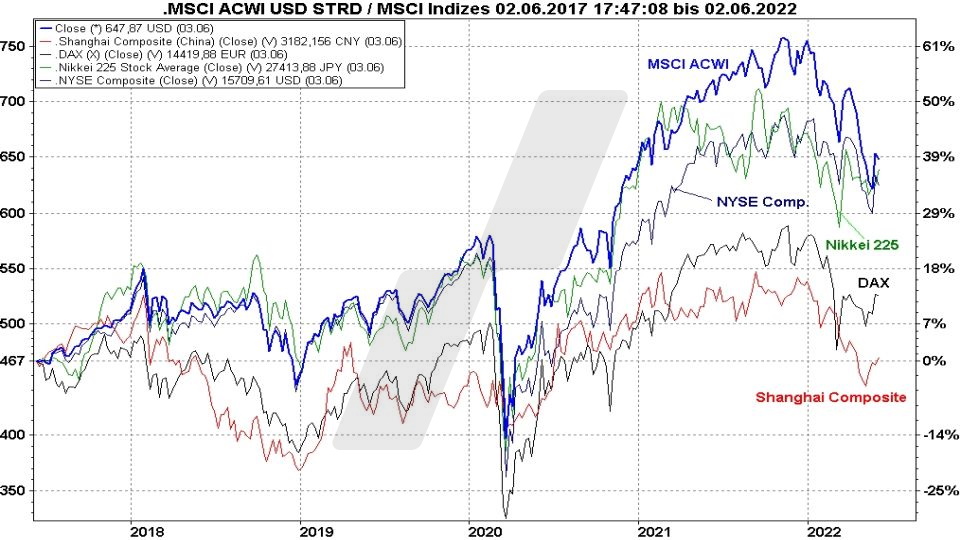

Comparing MSCI World/ACWI/EM for NASDAQACWI by mrjanuary — TradingView

¿Cómo indexarse al mundo? MSCI World vs MSCI ACWI Rankia

MSCI ACWI(オールカントリーワールドインデックス)の特徴。先進国と新興国の株式に投資 東北投信

Rastreando Valor MSCI World vs MSCI ACWI

Ländergewichtung im MSCI All Country World Index (ACWI) FinanzTilo

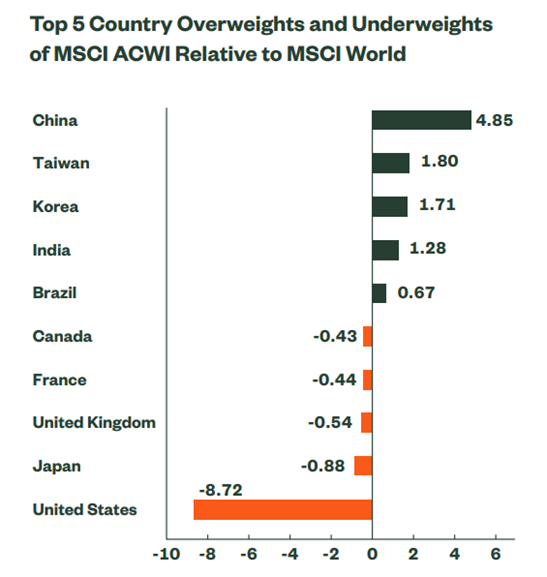

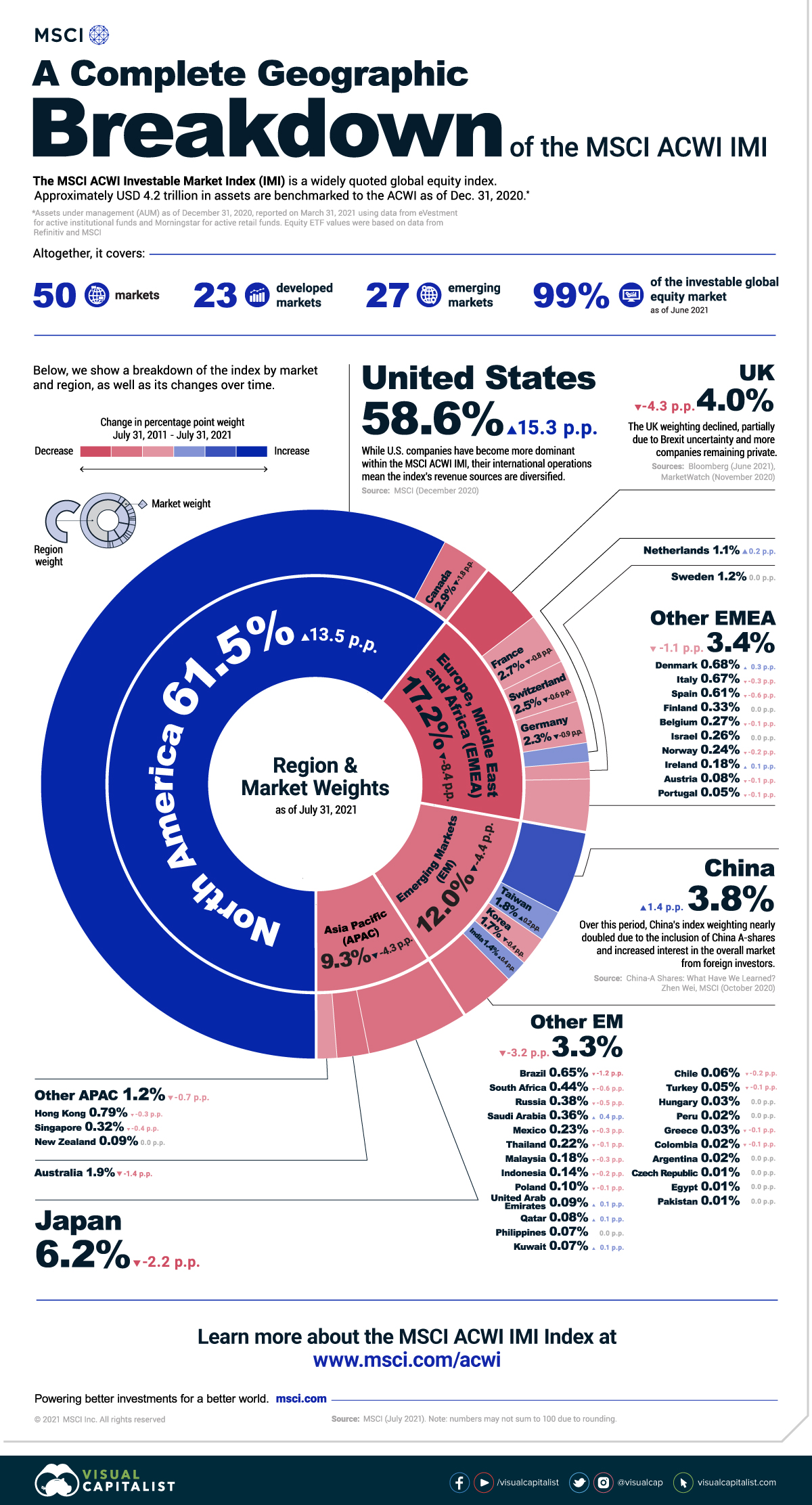

A Complete Geographic Breakdown of the MSCI ACWI IMI

MSCI ACWI vs. MSCI World CAPinside

¿Cómo indexarse al mundo? MSCI World vs MSCI ACWI Rankia

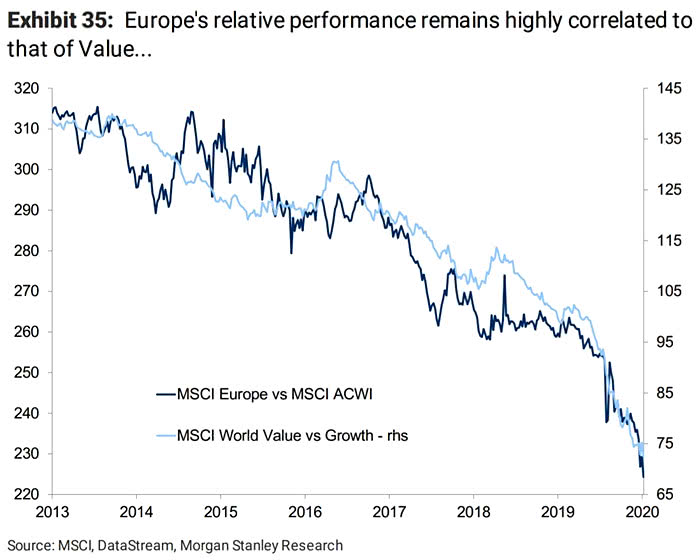

Performance MSCI Europe vs. MSCI ACWI and MSCI World Value vs. Growth

📈 MSCI World vs. MSCI ACWI Akciová část PORTFOLIA (II. část) YouTube

The iShares MSCI ACWI ETF seeks to track the investment results of an index composed of large and mid-capitalization developed and emerging market equities. Next: Previous: Performance. Performance. Growth of Hypothetical $10,000 . Performance chart data not available for display.. The chart below, taken from MSCI, shows the performance of MSCI ACWI vs World vs EM for the past 15 years. Looking at the chart, MSCI ACWI is very closely correlated with MSCI World. The cheapest ETF that tracks MSCI ACWI is SPDR MSCI ACWI UCITS ETF, with TER 0.40% p.a.. Meanwhile, the popular iShares Core MSCI World UCITS ETF (acc) has TER 0..